FinCEN's BOI Filing Deadline for Bartlett, IL Businesses: Avoid $500 Daily Fines – File by 01/01/2025!

The Corporate Transparency Act (CTA) requires Bartlett, IL businesses to submit Beneficial Ownership Information (BOI) to FinCEN by January 1, 2025, helping combat financial crimes and ensuring greater transparency.

As of today, 11-26-2024, Bartlett business owners have 36 calendar days (or 27 business days) left to file their BOI reports with FinCEN—don’t delay or face penalties of $500 per day.

Steps to Ensure Your Business is Compliant

1. Confirm If Your Business Must File

Deadline: ASAP

Most corporations, LLCs, and similar entities must file unless exempt (e.g., banks, nonprofits).

2. Identify Your Beneficial Owners

Deadline: 12-10-2024

Beneficial owners include those who:

-

Own 25% or more of the company, or

-

Exercise significant control over business decisions.

3. Collect Required Information

Deadline: 12-17-2024

Gather these details:

-

Business: Name, EIN, address

-

Beneficial Owners: Full names, addresses, birth dates, and identification details

4. Submit Your BOI Report

Deadlines:

-

Existing businesses: 01/01/2025

-

Companies formed in 2024: 90 days after formation

-

Companies formed in 2025: 30 days after formation

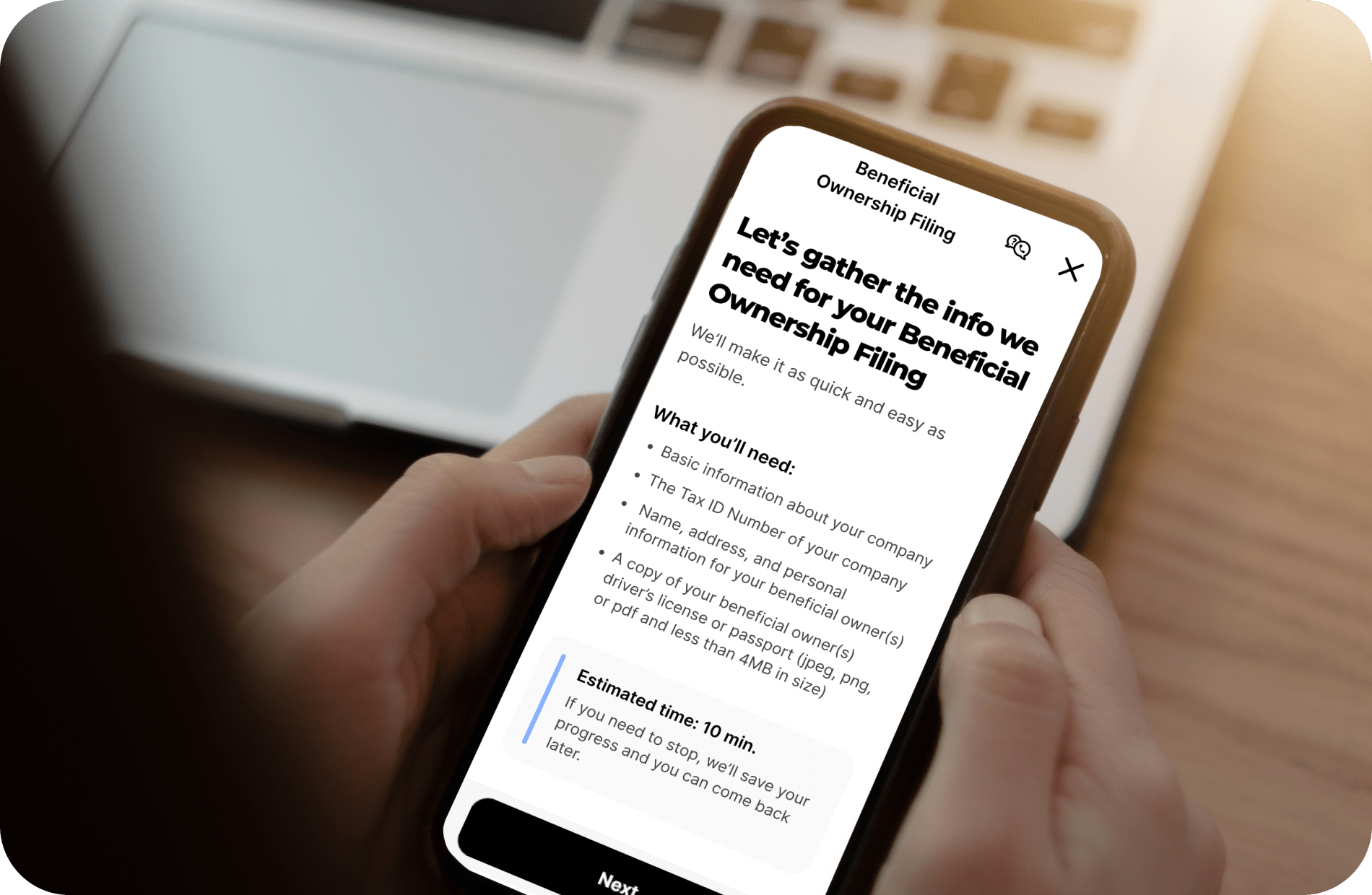

ZenBusiness offers a straightforward process to file your BOI report—check it out here.

Understanding BOI Filing

Who Must File?

Nearly all businesses in Bartlett must file unless exempt. For example, a family-run home services LLC would need to file, while a local charitable foundation might not.

What Defines a Beneficial Owner?

A beneficial owner is someone who either:

-

Owns at least 25% of the business, or

-

Exercises control over operations.

For instance, in a three-owner bakery where one partner owns 40%, that partner is a beneficial owner.

What Information Is Needed?

Your report will require:

-

Business Details: Name, address, EIN

-

Owner Information: Names, birth dates, addresses, and ID numbers

How and When to File?

BOI reports are filed electronically via FinCEN’s system. Deadlines vary:

-

Companies formed before 2024: 01/01/2025

-

Companies formed in 2024: 90 days after formation

-

Companies formed in 2025: 30 days after formation

Penalties for Missing the Deadline

Failure to file or providing false information can lead to $500 daily fines or imprisonment. Businesses have a 90-day correction period to fix errors without penalties.

Why ZenBusiness Is the Smart Choice

ZenBusiness simplifies the BOI filing process by offering expert support to ensure timely and accurate submissions. Save time and avoid fines—get started with ZenBusiness today.

Resources for Bartlett Businesses

Prepare your Bartlett business for the January 1, 2025, deadline. Don’t risk penalties—start your BOI filing process today!